Understanding the Insurance Appeals Process

The first step in comprehending the magnitude of the impact automation can have on this domain is to have a clear understanding of the traditional appeals process. When a claim is denied, healthcare providers are required to navigate a complex labyrinth of paperwork, regulations, and communication channels. This traditional approach is not only cumbersome and time-consuming but also prone to human errors, resulting in delays and increased costs for all stakeholders.

Recognizing these challenges, forward-thinking industry players have begun exploring the potential of automation in revolutionizing the insurance appeals landscape.

How AI and LLMs can make a difference

An LLM can analyze the denial letter and relevant patient data to pinpoint the reason for denial, whether it be coding errors or lack of authorization. Based on this analysis, it can then draft an appeal letter, adhering to legal and industry-specific language. With its advanced natural language capabilities, the model ensures that the appeal is not only accurate but also persuasive.

In tandem with automated workflows, this becomes a powerful tool. Once the LLM drafts the appeal, the workflow can manage its journey through the necessary channels. From automatic quality checks and required approvals to digital submission to the insurance company, each step is mapped out and executed without manual intervention.

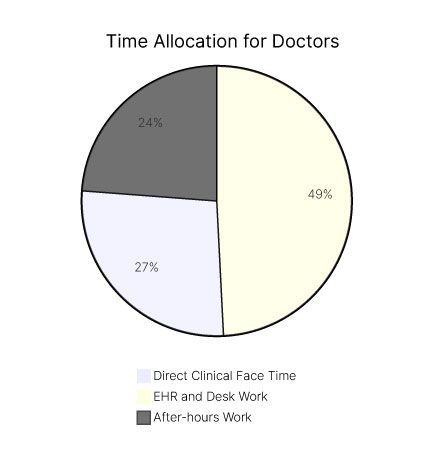

What we're looking at is not just automation, but intelligent automation. It makes the appeals process quicker, more accurate, and highly efficient, allowing healthcare providers to focus more on patient care and less on administrative hurdles. And let's be honest, in a sector where time can often mean the difference between life and death, that's not just beneficial—it's crucial.

The Traditional Appeals Process

The traditional appeals process can be likened to a chain reaction, one that starts with healthcare providers submitting paper-based documentation to the payer. These documents then pass through various stages, involving manual review, data entry, and multiple rounds of communication. This process is painstakingly slow, often causing unnecessary delays and frustration for both the providers and the patients.

At the beginning of the traditional appeals process, healthcare providers meticulously gather all the necessary documents to support their claim. These documents include medical records, diagnostic test results, treatment plans, and any other relevant information. Once compiled, the providers submit the paperwork to the insurance payer for review.

Upon receiving the documentation, the payer initiates the manual review process. This involves carefully examining each document to ensure compliance with the insurance policy's guidelines and requirements. The reviewers meticulously analyze the medical records, checking for any missing information or discrepancies that could potentially impact the claim's approval.

After the initial review, the payer may request additional information from the healthcare provider. This request often leads to a back-and-forth exchange of communication, as the provider gathers and submits the requested documents. This iterative process can be time-consuming, with each round of communication adding to the overall timeline of the appeals process.

The Role of Automation in Appeals

In sharp contrast, automation introduces the power of technology to streamline and expedite the appeals process. By leveraging intelligent algorithms and machine learning, automated systems can identify errors or missing information in real-time, eliminating the need for tedious manual inspections. Moreover, these systems can communicate with payers seamlessly, capturing and exchanging relevant data swiftly and accurately.

Automation in the appeals process brings forth numerous benefits. With the implementation of automated systems, healthcare providers can experience a significant reduction in the time it takes to resolve appeals. The intelligent algorithms can quickly analyze the submitted documentation, flagging any potential issues and providing suggestions for improvement. This not only speeds up the process but also minimizes the chances of errors or missing information.

Furthermore, automated systems can facilitate seamless communication between healthcare providers and payers. Instead of relying on manual back-and-forth exchanges, these systems can electronically transmit the necessary information, ensuring swift and accurate data exchange. This streamlined communication process reduces the chances of miscommunication or delays caused by human error.

Overall, the integration of automation in the insurance appeals process holds immense potential for improving efficiency, reducing costs, and enhancing the overall experience for all stakeholders involved. As technology continues to advance, it is crucial for the industry to embrace these innovations and leverage them to create a more seamless and effective appeals process.